The Causes,

Behaviors, and Termination

of Administrative

Monopoly in

by Unirule Institute of Economics

摘 要

简言之,“行政性垄断”就是行政部门设立的垄断。行政性垄断的定义是,由某个行政部门通过行政文件(如条例、规章或意见等)的形式授予经营主体——企业或兼有营利性活动的行政机构的垄断性权力,主要表现为进入壁垒的设置和对价格的管制获得特殊的便利和优势,形成不同程度垄断势力与地位的状况。

授予某一(类)企业垄断权是重大的经济决策,是对基本经济制度(“社会主义市场经济”)的改变,根据《立法法》,应由立法机关立法设立。根据法律保留原则,不经立法机关设立的垄断权,是对潜在竞争者的经济自由权和消费者选择自由权的限制。我国的实践中,大多数的行政性垄断的依据只是行政机关的规范性文件,属于行政部门的自我授权。这些利用行政性公权力设立的垄断权,具有某种程度上的违宪性质和违法性质。

广义地,行政部门利用其起草立法草案的优越地位,通过较弱的立法机关设立的有利于某(些)企业的垄断权,也可称为行政性垄断。自改革开放以来,我国宪法经历数次修正,其基本原则已有很大改变,增加了“社会主义市场经济”,“国家鼓励、支持和引导非公有制经济的发展”等内容。包含设立行政性垄断权内容的法律,已然与我国现行宪法的相关规定不相一致。

本研究中讨论的几个主要的行政性垄断产业,几乎都是从完全的计划体制中演化而来的。经过多年的财政体制改革,中央政府的主要财政收入来源已经变为征税收入。中央政府虽然还有改革国有企业的动力,却没有打破垄断的动力了。相反,减少国有企业所带来的财政负担的方法,可以是将行政性垄断权作为一种优惠政策给予国有企业。

随着中国经济改革的成功,巨大的国内市场逐渐显现出来,反过来突显对这些市场垄断的价值。由于不上交利润,也无需限制工资和奖励的发放,行政性垄断利益增加一分,拥有垄断权的企业就会分得将近一分;他们作为一个利益集团,就会有充分的动力去争取更大的行政性垄断权。

“院内活动”是指国有企业高层管理者通过游说行政部门官员而获得行政性垄断权的行为。一个原因是,行业部门官员与所属行业的企业高管可以转换身份,相互进入对方领域任职。这是从一个侧面反映行业行政性垄断的一项重要指标。这在我们研究的几个产业中都有显现。

上述“院内活动”因“部门立法”的存在而得以成功。“部门立法”产生的环境,是在我国的政治结构下,缺少对行政部门的实际约束,致使行政部门偕越自己的职权范围,直接和间接地对立法产生影响。所谓“部门立法”,就是行政部门主导甚至操控的立法;广义地,“部门立法”还意味着行政部门的行为实际上有着立法或修法的作用。

行政性垄断主要表现为设置进入壁垒和价格管制。而后者又可以分为两种。一种是卖方的或销售的价格管制;一种是买方的或购买的价格管制,表现为对行政性垄断权的拥有者在资源和其它投入的价格上的优惠以至免费。

只要存在制度性进入壁垒,即使其它条件与完全竞争相同,这种行政性垄断在一定的需求条件下同样会形成高价格、低产量以及福利损失。

利用行政部门设置的进入壁垒而形成的垄断高价,将原来消费者剩余转变为企业利润的情形,就是一种不公正的收入分配扭曲。如果将相当于垄断利润部分的资源用于其它由市场决定的用途,就可以多生产出一定数量的产品。这些产品的价值(广义地,还可加上消费者剩余)就是行政性垄断造成的垄断利润部分(即分配扭曲部分)的机会损失,也就是社会福利损失。

买方的管制价格(较低或零的要素价格)是一种严重的收入分配扭曲,它将本来属于国家(即全体人民)或其他经济主体的巨额财富转移给了国有企业;显然是不公正的。我们假定行政性垄断企业少支付的资源租金用于占用更多的生产要素,如劳动力,土地和资金,这些生产要素如果用于其它由市场决定的用途,可以生产出更多的产品,这些产品的价值(还可以加上消费者剩余)就是这部分分配扭曲带来的机会损失,也就是社会福利损失。

行政性垄断将财富以货币形式从消费者转移到了垄断企业(及其管理层和员工),后者却没有利用这些货币形式的资源生产出相应的产品。从整个社会来看,相当于有一大笔货币却没有对应的产品,因而必然会推动通货膨胀。

近些年来,调整存款准备金率,而不是调整利率,越来越成为实施货币政策的主要手段。调整的频率很高,一年最多可达到10次(2007年);调整幅度高达14个百分点,以至最高达到21.5%。这显得有些“反常”。而从银行企业的角度看,调整准备金率和调整利率却有着非常显著的区别。尤其是在实施紧缩政策时,采用提高准备金率的手段,会使银行免去提高利率的巨额成本。

由于公权力作为行政性垄断的构成因素,以及政府部门在行政性垄断的形成、维护和强化过程中的推动作用,在行政性垄断对经济效率和社会正义造成损害的同时,相关行政部门和权力机关的公信力和权威性也遭到相当程度的削弱和破坏。因此,与其说国有企业及其对国民经济的控制(其实就是行政性垄断)是“执政基础”,毋宁说是一种真正的“执政威胁”。

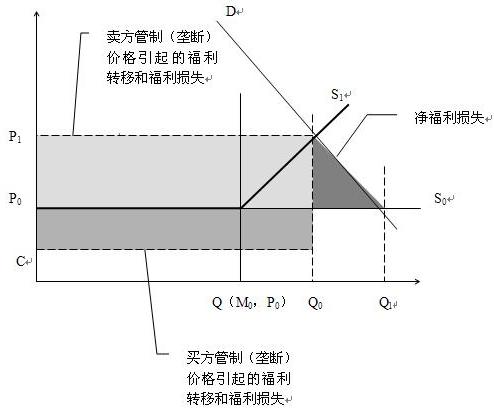

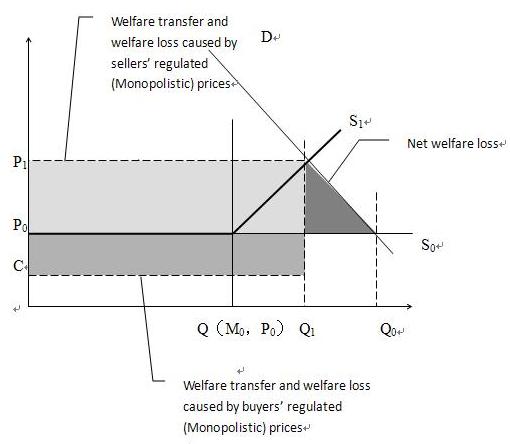

行政性垄断引起的福利损失与分配扭曲示意图

图中深灰色部分是行政性垄断带来的社会福利净损失,我们称之为“社会福利损失一”;图中浅灰色部分是由垄断(管制)价格带来的分配扭曲部分,我们称之为行政性垄断的“社会福利损失二”;图中中灰色部分是买方的垄断(管制)价格(即较低或零的资源价格)带来的分配扭曲,我们称之为行政性垄断的“社会福利损失三”。

社会福利损失一的估计:中国电信、中国移动和中国联通2003~2010年社会净福利损失为846亿元。2003~2010年电信行业的净福利损失上限总共为4417亿元。石油行业的社会福利净损失为13091亿元。

社会福利损失二——垄断利润估计:电信产业平均每年的行政性垄断租金约313亿元,这同时也是消费者被转移走的福利。石油行业由于垄断高价带来的垄断利润为4378亿元。食盐业垄断企业的垄断利润达到177亿元/年,这也同时是消费者每年的损失。这些数量都同时是社会福利损失的数量。

社会福利损失三的估计:2001~2010年,中石油公司共少付工业土地租金1668亿元;中石油和中石化的加油站用地少付租金1765亿元,少付的石油资源租金为2898亿元;三大石油企业少付的财务费用为2245亿元。这些数量都同时是社会福利损失的数量。

大多数市场经济国家的存贷款利率差的均值在1%~2%之间。而我国一年期人民币存贷款利率差多年来保持在3.06%,这主要依赖于压低存款利率1.5个百分点实现的;因较低的存款利率,按2011年的全国存款平均余额771560 亿元估计,全国个人与机构的利息损失则高达11573亿元。相当于当年GDP的2.6%。

在平均的情况下购买火车票还很困难,说明普通客车的供给存在着一般性的短缺。从两条东西大动脉,京藏高速和青银高速上的长长的运煤车龙就可以判断,普通铁路的货运供给也是短缺的。尤其是自2010年以来,京藏高速公路上竞频现长达

我们估算,当高铁的一条线路每天开出的列车对数高达129对时,高铁的一单位平均成本所创造的效用,才能与普通铁路相同;而我们知道,现在最繁忙的京沪高铁每天只开出50~90对列车。这意味着,每建

将前述行政性垄断的社会福利损失一(含铁路资源错置损失)、社会福利损失二和社会福利损失三累加起来,2010年由行政性垄断带来的社会福利损失至少有19104亿元。其中后两项共约16169亿元;这是没有对应产品和服务的货币量,必然带来通货膨胀压力;具体地,会带来2.44个百分点的通货膨胀率,相当于当年商品零售价格指数上涨率的78.74%。

用调整准备金率手段替代调整利率手段,中央银行上调一次0.5%的存款准备金率(以

再以2011年全年为例。用调整准备金率的方法替代调整利率方法,2011年的六次上调准备金率,每次0.5%,相当于为银行业或其主要借款人减少了15623亿元的利息支出。

即使现行《反不正当竞争法》与《反垄断法》在遏制行政性垄断方面还有所不足,但该法中仍然不乏约束行政性垄断行为的规范性内容。我国《反垄断法》规定的垄断行为包括:经营者达成垄断协议,经营者滥用市场支配地位,具有或者可能具有排除、限制竞争效果的经营者集中;同时,还专章规定禁止“滥用行政权力排除、限制竞争”。我们要充分利用我国法律中已有的反垄断资源。

对有关创设特定垄断权的立法或修法草案,应建立“立法回避制度”,即与某一特定垄断权相关的行政部门不应起草法案,至少要由立法机关委托某一(些)中立方起草;再如,对于特定产业的垄断权创设草案,立法机关应组织专家委员会进行咨询;又如,应将特定垄断权的创设作为一种单项权力的创设,即不能以“类”为单位创设垄断权,如以“关系国民经济命脉”为一类。

强调行政部门无权设立特定垄断权,任何行政部门通过规章、条例设立的垄断权都是非法的;应规定相关行政部门应回避与本部门有关的法律的“实施细则”或“条例”草案的起草;或加强对行政部门起草的特定法律的“实施细则”的审查,防止其中增加设立或扩张相关特定垄断权的条款。

行政部门对市场价格的管制的权力要经立法机关同意,才能设立。获得价格管制权力的行政部门在行使此种权力时,要受到《价格法》的约束,经过公正的听证会。特别地,要区分中央银行为实行货币政策而调整的利率和商业银行的利率,避免以实施货币政策为名,对商业银行利率实行管制。

关于公有制经济和全民所有制企业的宪法资源可以用来更有效地监督和约束使用和经营公共资源和国有资产的管理层。正是因为公有资源和全民所有的资产归全中国人民所有,就更应该加强对这些资源和资产的掌控,使其不致流失到使用和经营它们的管理层手中;也正是因为对公共资源和全民财产的监督在制度上和技术上都存在难度,才更应该在宪法中强调,在法律中特别设立相应制度和规则。

全国人大常委会作为专门的宪法监督机关,可以也应当依照现行宪法,对于涉嫌违宪设立行政性垄断的立法进行清理、审查,对于确实违宪的,应予以撤销或宣布违宪无效。当然,与此同时,也可以依据现行的宪法性法律《立法法》的规定,分别由相应的有权机关(主要如全国人大常委会或国务院)清理、撤销现有的行政部门设立行政性垄断的各种行政文件。

破除行政性垄断的司法改革建议包括,第一,不仅仅是要允许当事人(而不限于在位的企业)直接对涉嫌行政性垄断的企业向法院起诉;而且起诉不仅仅限于请求垄断企业承担民事责任,而是可以请求法院审查垄断地位的合法性。

第二,修改相关立法,使法院对行政性垄断案件享有实质的审查权和对企业垄断地位的处分权。

第三,改造现行的反垄断行政执法机制。关键在于:机构和职能要整合,权威要提高(例如,不能依赖于“向上级机关建议”),程序要正当(核心是确保公正、透明和参与,而不能内部操作)。

第四,要建立对行政性垄断的公诉制度。

行政层面的破除行政性垄断的改革,可以包括以下几个方面。

第一,直接鼓励各种企业,包括民营企业和国有企业,进入到没有现行法律规定垄断权的产业领域中。如在石油产业,就只有行政文件、而没有法律限制进入。对任何阻碍企业进入的行政部门,可施行行政惩罚。

第二,通过行政命令,废除和禁止行政部门(及其控制的行政协会)自我授予的垄断权。

第三,要求财政部和国土资源部等相关部门,设立专门机构,核查企业占用的公共自然资源(包括土地、采矿权等)的数量,并按市场价格向占用资源者征收租金。

第四,要求国有资产监督管理委员会参照社会平均工资水平,合理设置国有企业工资水平上限,对超出上限者予以惩罚。

第五,要求财政部设立专门机构,对国有企业,尤其是中央国有企业的财务进行专门监督,对利润分配方案向国务院提出建议,严格执行利润的上交,并对利润再投资部分予以监督。

第六,从长远看,要推动国有企业从营利性领域退出。

Abstract

In short,

the "administrative monopoly" is a kind of monopolies established by

the administrative departments. The definition of Administrative monopoly is

that an administrative department, through issuing administrative documents

(such as regulations, statutes or suggestions), grants the monopolistic

power(s) to business agents--enterprises or profit-making administrative

bodies, which are realized as accessing to exceptional facilities and

advantages, forming different degrees of monopolistic forces and the status of

the situation by setting of barriers to entry and regulating prices.

Granting

the monopolistic powers to enterprises is important economic decisions and a

change of basic economic institutions (the "socialist market

economy"). Under the Law of Legislation, monopolies shall be established

by the legislature. According to the principle of law reservation, monopolies,

without establishments of legislature, are the damages to economic freedoms of

potential competitors and choosing rights of consumers. In practice in

Broadly,

the Administrative departments use their superiority over drafting legislative

acts to establish monopolistic powers in favor of some enterprises through a

weak legislature, also regarded as administrative monopoly. Since reform and

openness,

Almost

all of the main administrative monopoly industries discussed in this study is

evolved from the complete planned economy. After years of fiscal system reform,

the Central Government's main sources of revenue have become taxable income.

Central Government has incentive to reform state-owned enterprises but no

incentive to abolish the monopolistic powers. Instead, granting administrative

monopolies as preferential policies to State-owned enterprises could be a way

to reduce the fiscal burden from State-owned enterprises.

With the

success of

"In-house

Lobbying" refers to the behavior that top managements of State-owned

enterprises get administrative monopolies through lobbying administration

officials. One of the factors is that industry officials and executives in

firms can transform identities; mutual access to each other's serving area.

This is an important indicator of the administrative monopolies of industries.

It appears in several industries in our research.

The above

“In-house Lobbying” successes because of the existence of “departmental

legislation.” The existence of “departmental legislation" is because under

the political structure of China, the lacking of practical constraints for

administrations leads to the administrative departments, beyond their

authorities, influence legislation both directly and indirectly. The so-called

"departmental legislation" is administrative-led or even manipulated

legislation. Broadly, "departmental legislation" also means that the

administrative departments practically make or amend the laws.

The

administrative monopolies perform as setting barriers to entry and regulating

prices, while the latter can be divided into two categories. One is sellers’

price- regulating; the other one is buyers’ price-regulating, leading to the

owners of administrative monopolies may obtain resources and other inputs at

discounted even zero prices.

As long

as the institutional barriers to entry exist, even if the other conditions are

the same as perfect competition, under some level of demand, administrative

monopolies may lead to high prices, low production and welfare losses.

Monopolistic,

high prices caused by administration’s setting barriers to entry redistribute

the original consumer surplus to corporate profits. It is an unfair

distribution of income distortions. If using the monopolistic profits as the

way which market decided, they can produce a certain number of products. The

value of these products (in broad terms, can also be combined with consumer

surplus) is the opportunity loss caused by administrative monopolistic

(distribution of distorted part), known as social welfare losses.

Buyer's

price regulating (low or zero factor prices) is a serious distortion of income

distribution. It transfers huge wealth which originally belonged to the State

or other economic agents to the State-owned enterprises. It is clearly unfair.

We assume administrative monopolies use the rents that they miss to pay to

occupy more factors of production such as labor, land and capital. If these

rents were used in other ways that determined by the market, they can produce

more products. The value of these products (can also be combined with consumer

surplus) is opportunity losses caused by distortions, also known as social

welfare losses.

Administrative

monopolies transfer wealth in the form of currency from consumers to the

monopolistic companies (including their management and staff), which did not

use these monetary resources to produce a quantity of products they should do.

Take the perspective of society, a large sum of money does not have

corresponding product, which will inevitably promote inflation.

In recent

years, adjusting the deposit reserve ratio, rather than adjusting interest

rates, increasingly becomes the primary means of implementing monetary policy.

Frequency of adjusting is very high. It is up to 10 times a year (in 2007).

Adjustment range is up to 14%, so that the highest rate is 21.5%. This is

"unusual". From the point of view of bank, adjusting the reserve

requirement ratio and interest rates has a noticeable difference. In particular

when implementing tightening policies, increasing reserve ratios will enable

banks to avoid the huge costs of raising interest rates.

Because

public powers are integral factor of administrative monopolies, and impetus of

governmental departments in the formation, maintenance and strengthening of

administrative monopolies, credibility and authority of the relevant

administrative departments were considerably weaken and undermined, while

administrative monopolies damage economic efficiency and social justice.

Therefore, state-owned enterprises and their control over the national economy

(in fact, is the administrative monopolies) is the real "threat to

ruling" rather than "ruling basis".

Figure of

welfare loss and distribution distortions caused by administrative monopoly

The deep

grey part in the figure is the net loss of social welfare caused by

administrative monopolies, we called it "social welfare loss I"; The

light grey part in the figure is distribution distortion cause by sellers’

monopolistic (regulating) prices, we called it "social welfare loss

II"; the grey part in the figure is distribution distortion caused by

buyers’ monopolistic (regulating) prices (lower or

zero resources prices), we called it "social welfare loss Ⅲ".

Estimation

of Social welfare loss I: the net social

welfare losses of China Telecom, China Mobile and China Unicom from 2003-2010

is about 84.6 billion RMB. From 2003 to 2010, the cap of net welfare loss of

telecom industry is about 441.7 billion RMB, and the net social welfare losses

of oil industry is about 1309.1 billion RMB.

Estimation

of Social welfare loss Ⅱ: The annual administrative

monopoly rent of telecommunication industry is about RMB 31.3 billion on

average. It is also the amount of transferred consumer surplus. Oil industy of

monopolistic profit brought about by high monopolistic prices is about 437.8

billion RMB. Salt industry monopolistic profit is as high as RMB 17.7 billion

per year. This also is the loss of consumers each year. These numbers are the

amount of social welfare losses.

Estimation

of Social welfare loss Ⅲ: From 2001 to 2010, the amount of

land (for industrial use) rent which CNPC miss to pay is about RMB 166.8

billion; the amount of land (for gas station use) rent which CNPC and Sinopec

miss to pay is about RMB 176.5 billion; the oil royalty they miss to pay is

about 289.8 billion RMB; the financing costs which the big three in oil

industry together miss to pay is about 224.5 billion RMB. These numbers are

also the amount of social welfare losses.

The mean

of difference between deposit interest rate and loan interest rate in most

market economy countries is in 1%~2%, but the difference between one-year loan

and deposit rates is 3.06% over several years in

Generally,

it is still very difficult to purchase train tickets. It implicates there is a

general supply shortage on ordinary train. From Beijing-Tibet Expressway and

Qingdao-Yinchuan Expressway, we can tell the supply shortage of general railway

freight. Especially since 2010, there are frequent traffic jams in

Beijing-Tibet Expressway which are over

Report

estimates that when the number of the high-speed railway trains departed is up

to 129 pairs daily, the utility created by unit cost of high-speed railway is

equal to ordinary railway. As we know, the most busy Beijing-Shanghai

high-speed railway depart only 50~90 pairs of train daily. This means that the

decrease in the construction of normal railways, caused by every kilometer

high-speed railway constructed, will lead to a net social loss. In accordance

with the relevant data, the amount of welfare losses caused by the misallocated

resources between high-speed and conventional railway is about RMB 53.3 billion

per year.

The total

amount of social welfare loss I(including the loss caused by

resources misallocation in railway), social welfare loss Ⅱ and social welfare loss Ⅲ caused by administrative

monopolies is RMB1. 9104 trillion in 2010, while the amount of latter two is

RMB 1. 6169 trillion, which is such a quantity of money without corresponding

products and services, and inevitably brings about inflation pressure.

Specifically, it will cause inflation by 2.4%, equivalent to 78.7% of

commodity-retail-prices-index inflation that year.

Taking

adjustment of reserve requirement ratio as an alternative means of adjustment

of interest rates, the Central Bank raised deposit reserve ratios by 0.5% (as

of June 20, 2011). The equivalent interest rate change is 0.375%. It can save

the banks from paying interest on deposits of RMB 321.7 billion.

Taking

adjustment of reserve requirement ratio as an alternative means of adjustment

of interest rates, the Central Bank raised reserve ratios six times in 2011,

each time by 0.5%. It is equivalent to reduce the interest expense by RMB

1.5623 trillion for banks or their main borrowers.

Although

there are some shortcomings in current Anti-Unfair Competition Law and

Anti-monopoly Law, there are still some normal content to constraint behaviors of

administrative monopoly. The monopolistic behaviors the Anti-monopoly Law

defines include achieving monopolistic agreements between business agents,

abusing monopolistic positions, concentrating firms for purpose of excluding,

limiting competitors. There is a certain chapter in the law to state forbidding

“abuse of administrative powers to exclude and to limit competition.”

It should

establish "legislation evaded rule" for drafts of making or amending

laws to establish specific monopolies. In other words, the administrative

departments that related to specific monopolies should not draft Bills. At

least it should be drafted by a neutral agent(s) that authorized by

legislature. Moreover, the legislature should organize the Committee of experts

to consult about the drafts establishing of monopolies for specific industries.

Furthermore, the establishing of a specific monopoly should be treated as a

single monopoly, that is, we cannot use "category" as the unit to

create a monopoly. For instance, it cannot set "national economy

related" as a category.

Administrative

departments do not have the power to establish specific monopolies. Any

administrative department establishes monopoly through regulations or statutes

is illegal. Setting up the rules that related administrative departments should

evade the drafting of related "implementation details" or

"regulations"; or strengthen the reviewing on drafting of

"implementation rules" of specific laws to prevent adding the

articles related to establishing or expanding of specific monopolies.

The power

that administrative departments can regulate the market price should be

empowered by the legislature. When an administrative department using its price

regulating power, it should be bound by the Price Law, going through fair

hearings. In particular, it should differentiate between adjustments of

interest rate to implement monetary policy by the central bank and the interest

rates of commercial banks, for avoiding regulation of commercial bank interest

rates in the name of implementation of monetary policy.

The

Constitutional resource of public-owned economy and state-owned sector could be

used to monitor and constraint the managements of state-owned companies more

effectively. Because public resources and assets should be owned by all people,

the supervision of these resources and assets should be strengthened. It must

be assured that these assets should not be controlled by managements of

state-owned companies. Because it is difficult to monitor public resources and

assets on institutional and technological term, it should be emphasized in

Constitution, and establish corresponding institutions and rules in laws.

Standing

Committee of the National People's Congress, as a specialized constitutional

supervisory authority, can and should review and terminate suspected

unconstitutional establishment of administrative monopolies. It should declare

unconstitutional and terminate unconstitutional ones in accordance with the

current Constitution. At the same time, based on the provisions of existing

constitutional law, the Law of Legislation, empowered authorities (mainly as

Standing Committee of the National People's Congress or the State Council)

terminate, revoke the existing, various administrative files for establishment

of administrative monopolies respectively.

The

judicial reform proposals of breaking administrative monopolies including:

first of all, allow clients (but is not limited to enterprises) directly sue

the enterprises suspected of administrative monopoly; at the same time,

prosecution is not limited to request monopolistic enterprises to bear civil

liability, but also have the right to request the Court to review the legality

of monopoly.

Secondly,

emend the relevant legislation, so that courts could have the substantive power

to review the cases of administrative monopoly and to dispose monopolistic

status.

Thirdly,

renovate existing antitrust administrative enforcement mechanisms. The keys are

to consolidate on institutions and functions, improve authority (for example,

it cannot rely on "recommendations to the superior authority"), and

legitimate the process (the core is to ensure a fair, transparent and

participatory, not internal operations).

Fourthly,

it should establish the public prosecution system to administrative monopolies.

Reformation

of breaking administrative monopolies at the administrative level as below:

Firstly,

directly encourage enterprises, including private enterprises and state-owned

enterprises, enter to the areas which absence of legal provisions of

monopolies. For instance, in the petroleum industry, there are only the

administrative files, but no legal restrictions to enter. The administrative

departments that impede enterprises to entry the industries mentioned above

should be imposed administrative penalties.

Secondly,

abolition and prohibit self-granted monopolies of administrative departments

(or industrial associations controlled by them) by executive orders.

Thirdly,

require the Ministry of Finance, the Ministry of Land Resource and other

related departments to set up specialized agencies to verify the number of

public natural resources (including

land, licenses of mining, etc) occupied by enterprises, and charge rents from

resources holders at market prices.

Fourthly,

require State-owned Assets Supervision and Administration Commission of the

State Council to set a reasonable state-owned enterprises ' wage ceiling

according to the levels of average wage in society, and punish the people who

get wage above the bound.

Fifthly,

request the Ministry of Finance to establish specialized agencies to monitor

state-owned enterprises, particularly central state-owned enterprises, to give

recommendations on the distribution of profit to the State Council, to strict

implement the profits surrender, and to supervise reinvested part of profit.

Lastly,

promote the state-owned enterprise to withdraw from the profit-making area in

the long run.